Field Notes: The Impact of Impact on CEOs & Investors

Both CEOs and institutional investors increasingly value the significance of environmental, social and governance (ESG) factors, according to PWC’s 19th Annual Global CEO Survey and Natixis’s 2015 Institutional Investor Survey.

As Heron moves towards having our entire portfolio invested for mission, we are inspired by these CEOs and institutional investors who are transforming their practices to reflect the interrelation of social and financial performance. PWC reports that many CEOs have seen that efforts to incorporate sustainability are compatible with profitability. Often profitability is the platform that helps provide value for a wider set of stakeholders, as Richard Goyder, Managing Director of Wesfarmers explains:

I don’t think, as a listed company, there’s any doubt that our primary objective is to generate returns for our investors. But we have to do that sustainably, we have to do it ethically and we have to do it in a way that contributes to the communities in which we operate. That’s for our own good anyway. Because if we help the communities in which we operate then those communities will have more capacity to do business with us in the future.

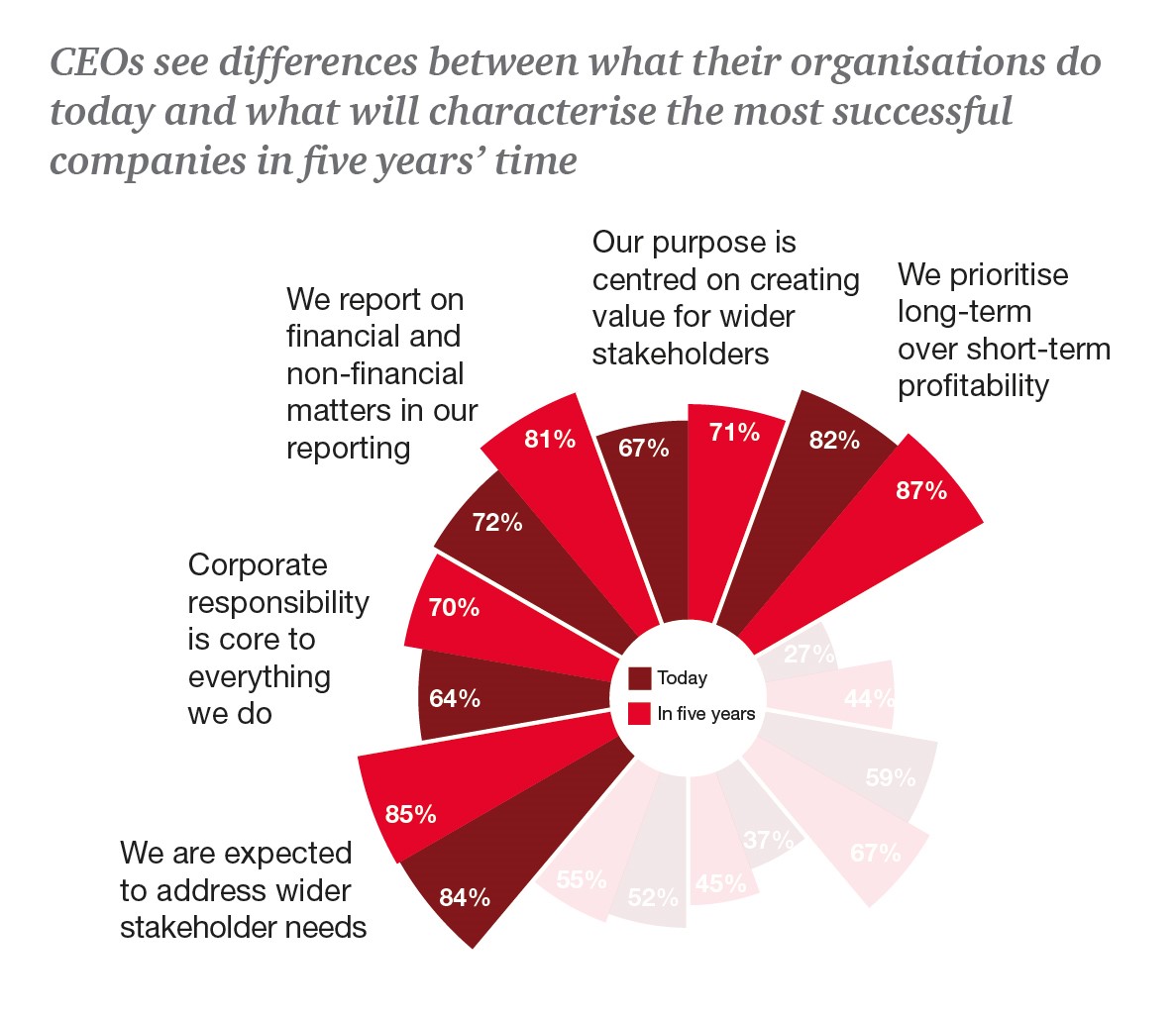

Twenty-seven percent of CEOs believe that, in addition to low cost, convenience and functionality, customers are seeking relationships with organizations that address wider stakeholder needs. Forty-four percent believe this will be true in five years, putting a premium on the way companies conduct themselves in global society.

Demographics have led society into the “era of the good consumer.” The millennial generation and their growing purchasing power have led to growing evidence that more consumers seek out ethical and sustainable products. Unilever’s ‘Sustainable Living’ brand now equals half the company’s total growth and Campbell’s acquisition of Plum Organics gives a window into millennial parent consumers. Even in emerging markets, CEOs from Africa and Asia Pacific understand that consumers are more likely to seek out organization that address needs to a wider set of stakeholders, despite challenges of forging middle class lifestyles amidst rapid urbanization, diminishing access to national resources, pollution, and overcrowding.

Meanwhile, institutional Investors surveyed by Natixis expressed the difficulty in finding alpha (the return on an investment or performance compared to a benchmark market index) as markets become more efficient. However, while to date ESG screens have been used to insulate portfolios from public relations risk, the survey also shows that investors are beginning to wonder if there is alpha to be found:

Many are also beginning to see that ESG may also provide direct investment benefits. Half (50%) of those surveyed say these strategies could also be a source of potential alpha, but there is much more to be learned as only 26% have found that incorporating ESG into investment decision making has had a positive impact on investment performance.

Managers identify some of the key challenges to seeing more broad-based adoption of ESG: the difficulty in measuring performance (52%) and a lack of transparency in reporting (38%). With a growing number of managers offering specialist capabilities within this realm, these concerns will likely dissipate.

These specialists are looking at ESG through a new lens, investing in key trends such as green energy, in which businesses will benefit from increased societal focus on sustainability. This kind of impact investing may be the opening for more managers to incorporate ESG into institutional strategy. It may be one critical reason why more than four in ten (44%) of those surveyed say ESG will be a standard practice for most managers within five years.”

Comments are closed here.